THIS MATERIAL IS A MARKETING COMMUNICATION.

Autonomous, Electric Vehicles Drive Semiconductor Development

TAM expansion driven by electrification and autonomous driving

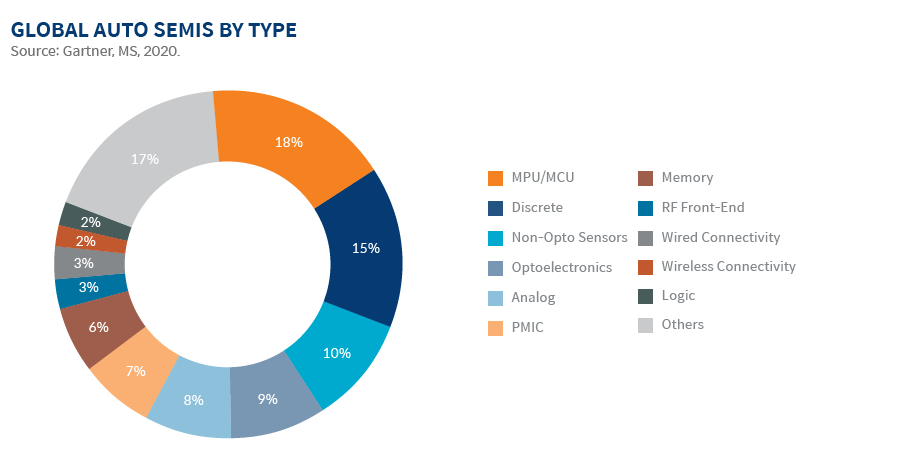

Electrification of automobiles is an unstoppable trend. The semiconductor industry is well positioned to support this transition and benefit from a significant increase in total addressable market (TAM). A typical electric vehicle (EV) has twice as much semi content compared to an internal combustion engine car, at around $800.1 A large portion of the incremental content comes from power semiconductors. BOM (bill of materials) for a full self-driving car can be even higher by using silicon for self-driving computers. Rapid EV adoption is expected to drive the power semiconductor market to grow from $7bn in 2020 to $24bn by 2030.2 Automotive microcontroller (MCU) market is projected to reach over $12bn by 2025, from $7.6bn in 2021.3 Key suppliers include NXP, Renesas, Infineon and Texas Instrument.

The development of higher-level self-driving vehicles has also driven the demand for high-performance systems-on-a-chip (SoC) to support new architectures and process input from an array of sensors. The SoC enables autonomous vehicles’ perception, planning, control, and more. Mobileye estimates the TAM for ADAS (Advanced driver-assistance systems) related silicon to reach $4.5-6bn in the next few years,(Mobileye 2021) and the market will be significantly larger once L4/L5 vehicle penetration moves up as ASP (average selling price) for full self-driving SoC can be $500-$1000+.4

Power Semiconductors is the key component to the electrification of automobile

IGBT (insulated-gate bipolar transistor): IGBT is a silicon-based power semiconductor which is highly adopted by EVs for its cost, stability and mature manufacturing technology. Infineon is the market leader with around 30% market share.5

SiC: Silicon Carbide is a new material used in power semiconductors for EVs. It provides higher efficiency and better performance compared to silicon-based solutions. ST Micro, Wolfspeed, Infineon and Rohm are key suppliers.

Foundry Technology Migrationto support future AD chips

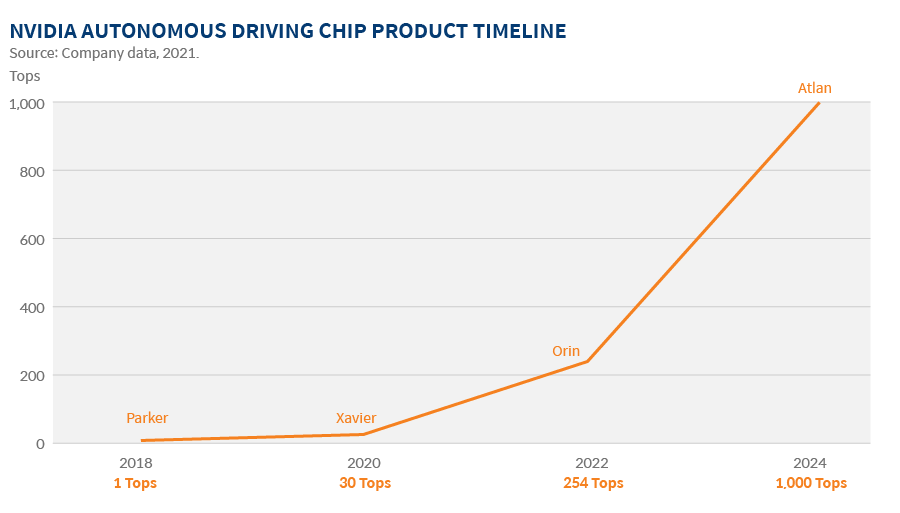

Migration in semiconductor technology allows companies to design faster chips with lower power consumption and higher transistor density. This is crucial for processing and deploying complex neural networks in autonomous vehicles. AD (autonomous driving) workloads are challenging as they are compute-intensive, complex concurrencies and real-time. TSMC is leading the foundry mode migration.

Chip suppliers have an aggressive timeline with the help of foundry to achieve rapid performance improvement over the next few years. Nvidia is currently a leader in third-party autonomous driving SoC, while Tesla has the most competitive in-house designed autonomous driving SoC. Other third-party suppliers such as Mobileye (Intel) and Horizon are also ramping up product performance rapidly.

Digital Cockpit is the new standard

Tesla set the standard for digital cockpits in the industry. Automakers are transforming the cabin with an always-connected digital cockpit, enabling a better multimedia experience, smartphone-like operating system, smart navigation and more. As the level of autonomy increases in vehicles, eventually freeing the driver, the infotainment functions become more significant.

A range of chips are required to support the new digital cockpit, including 1) connectivity related chips like modem, Bluetooth, Wifi; 2) SoC to power the infotainment system; 3) other chips like power management, display driver, audio, etc. to support various hardware.

1. Mirae Asset, 2022

2. Credit Suisse, 2021

3. IC Insights, 2021

4. Mirae Asset, 2022

5. Mirae Asset, 2022

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.