THIS MATERIAL IS A MARKETING COMMUNICATION.

China Clean Energy Review 1H22

Solar Industry: Profitability rising on strong demand

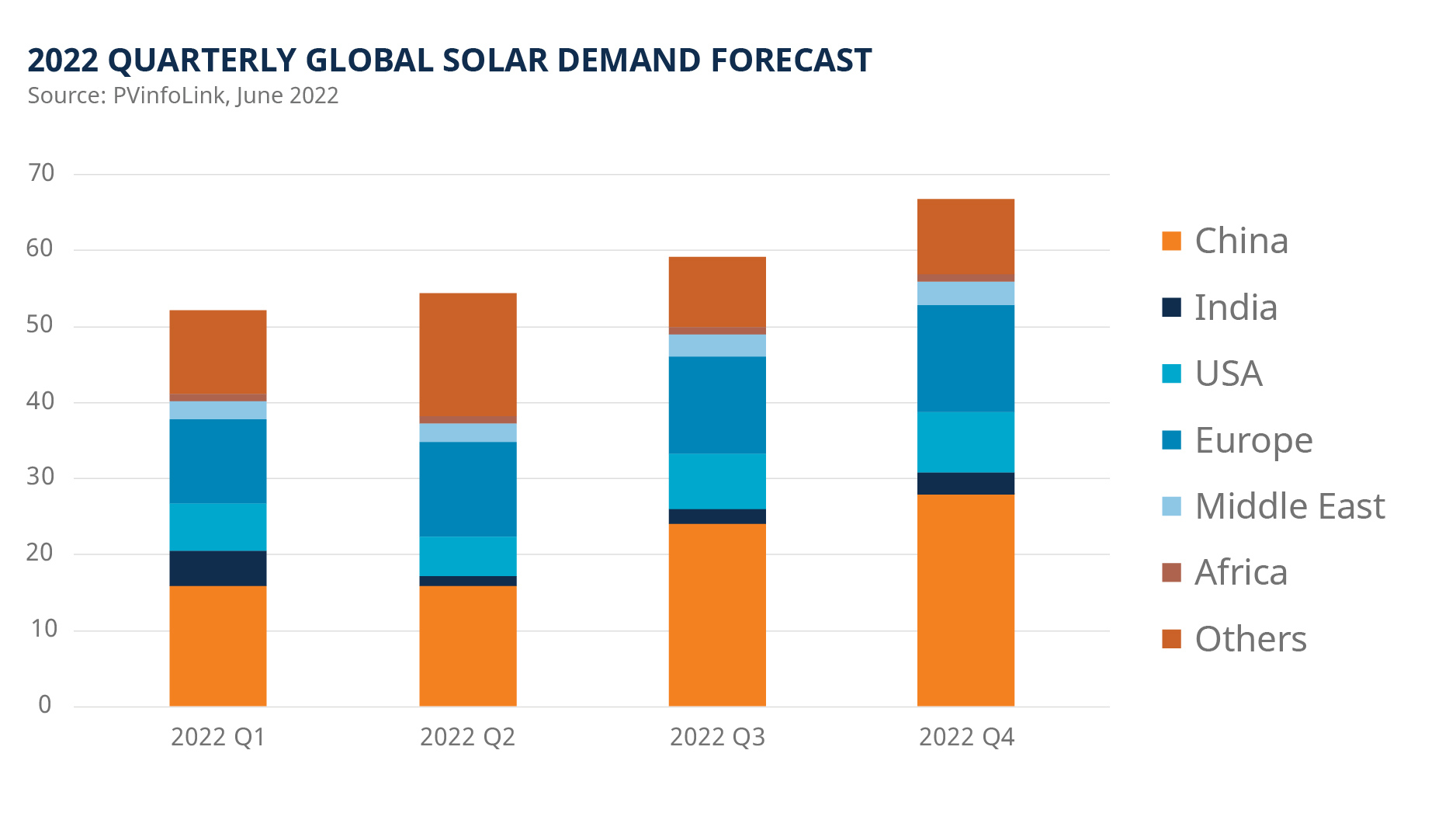

Global solar demand turned out to be stronger than expected at the end of 2021, mainly supported by the European market following the Russia-Ukrainian war and subsequent energy crisis, as well as China which is on the way to carbon neutrality. The US government’s recent U-turn on solar panels further boosts demand, announcing a two-year tariff suspension for solar panel imports from four Southeast Asian countries. This includes Cambodia, Malaysia, Thailand, and Vietnam – all of which Chinese companies hold manufacturing capacity. The change in stance ensures that the US will have access to a sufficient supply of solar modules to meet domestic electricity generation needs. As a result, solar installations for the whole year have lifted to 220-240GW (versus initially 200GW), of which 80-90GW will come from China (versus initially 75GW).1

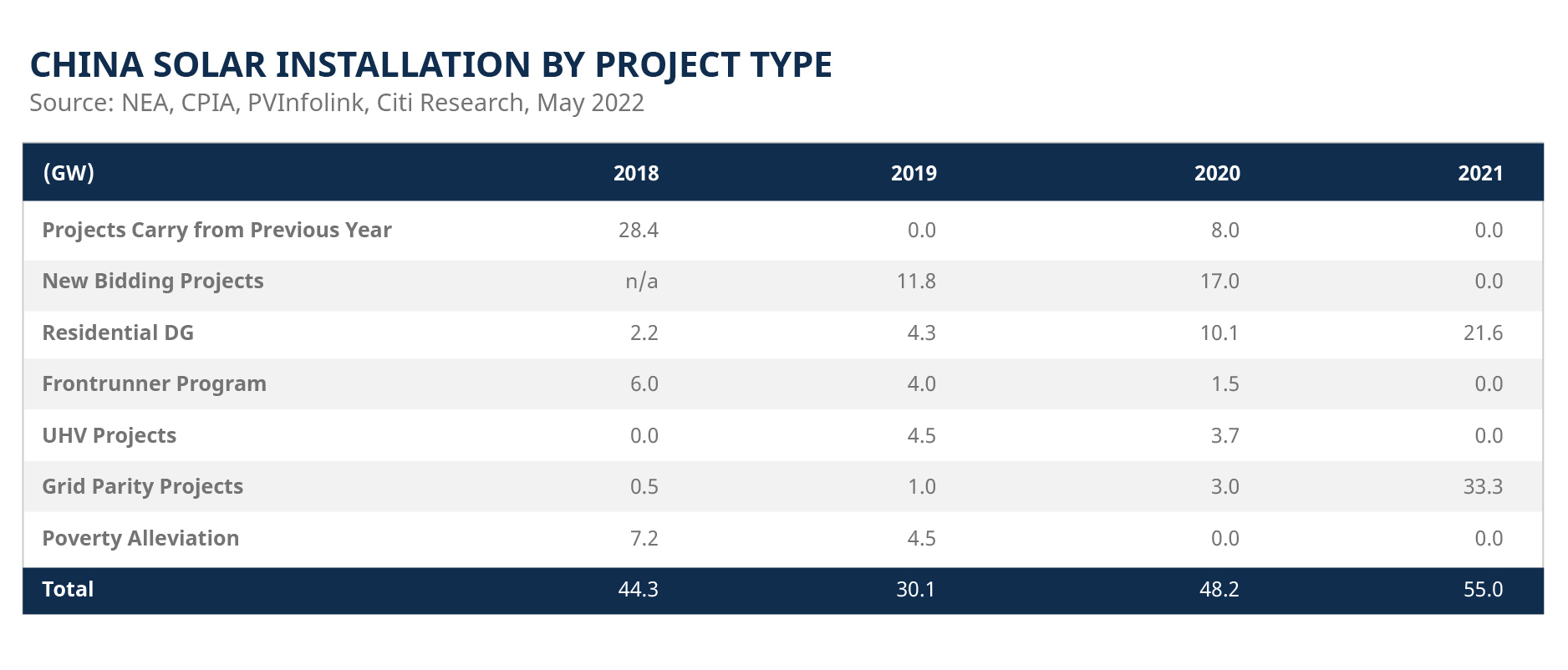

Looking back at 2021, Chinese solar farm investors delayed most of their large-scale projects after module prices elevated. Many were waiting for an end to the polysilicon shortage, at which point module prices were expected to revert to historical lows of RMB 1.5-1.6

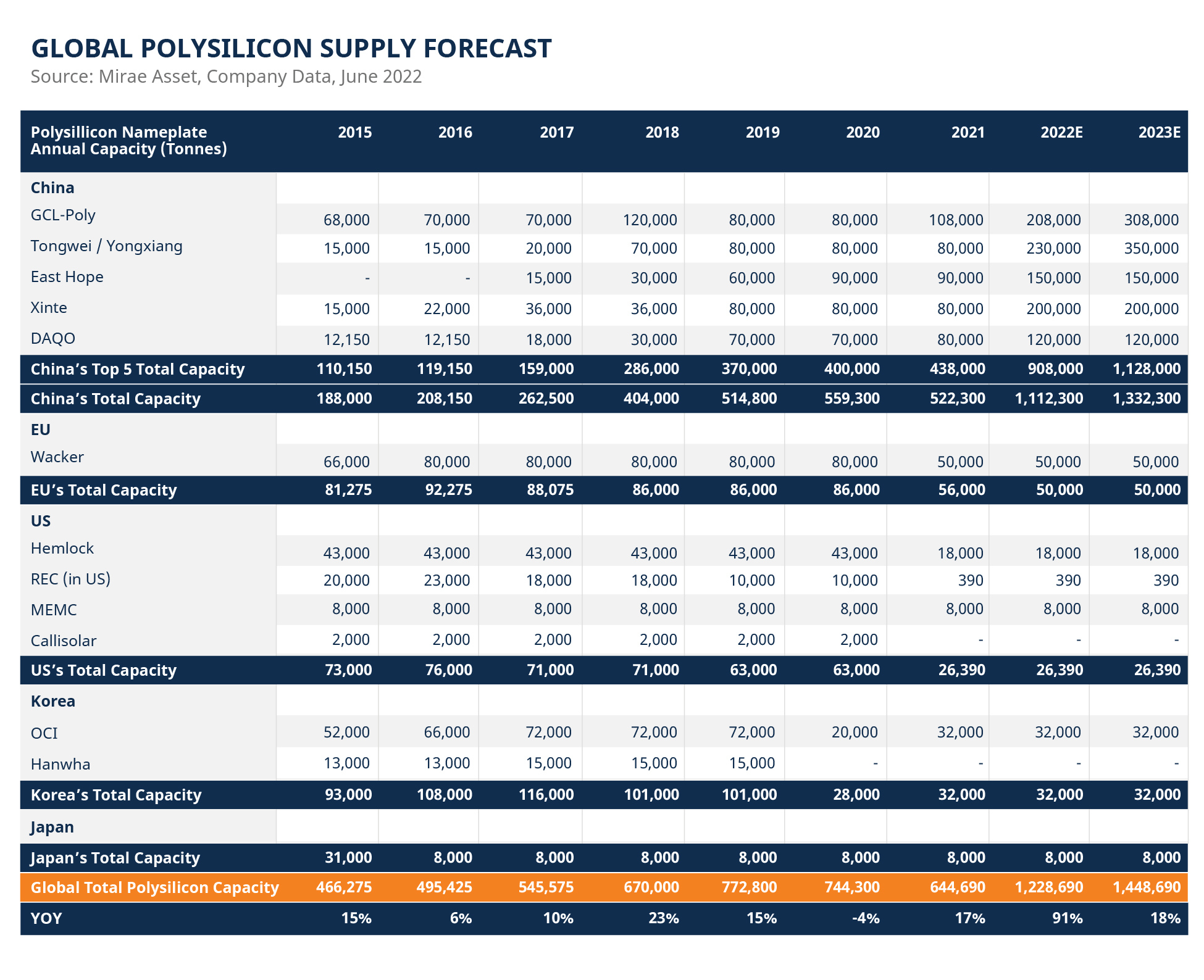

Regarding the solar value chain, the dynamics of polysilicon in the upstream will largely remain tight until the end of the year, or maybe even next year if demand growth proves stronger than consensus. However, all the top five polysilicon producers have added a significant number of new capacities in 2021 or 2022.2 Consequently, leading polysilicon players have strong bargaining power against wafer makers who are severely oversupplied. The wafer end is rapidly heading to larger sizes in which M10 wafers show great competitiveness. Despite raw material bottlenecks, utilization remains at a relatively high level of over 80%. The profitability of solar cell and module products is improving in 2022, thanks to solid demand.3

What’s worth mentioning is the imminent technological innovation and differentiation of more powerful solar cells. In 2022, N-type solar cells are showing a blowout trend, especially with the large-scale mass production of leading integrated module companies such as Jinko Solar,

Wind Industry: Strong wind new tendering amid policy tailwind and strong project economics

China wind farm project owners should achieve a decent internal rate of return (IRR) through new projects tendered during

On top of the improved project economics, we continue to see positive policy support. According to a notification jointly issued by the NDRC (National Development and Reform Commission) and NEA (National Energy Administration) on 30 May 2022, approval of new wind projects could be changed to a registration and recording process, meaning the approval process is likely to accelerate. This could be beneficial, especially for distributed wind in rural areas which tend to have a smaller scale. On 1 June, the NDRC officially issued the long-awaited 14th Five-Year Plan (FYP) for renewable energy. Key numerical targets are in line with earlier guidance and market expectations. The NDRC guided total wind and solar power output to double during the 14th FYP and accumulated wind and solar capacities to reach >1,200GW by 2030. Progress in the mega-size wind and solar power bases are on track. Several provinces are pushing hard on offshore wind installation plans, including Shandong, Fujian, Guangdong and Guangxi.

Competition along the value chain has marginally loosened in 2Q22. Solid wind project economies, year-to-date strong policy tailwinds, and new tendering volumes have led to marginally improving competition along the wind supply chain (component vs turbine vs operators). Competition among the key turbine makers are more rationalized. The moderating raw material inflation will also be positive for manufacturers’ margin in 2H22.

Utilities Industry: Legacy subsidy issues getting resolved

Resolving legacy subsidy issues is a positive step as this will improve the cash flow situation for wind and solar farm operators. As background, in the past, when renewable power had not reached grid-parity status, the Chinese government promoted the development of renewables by providing subsidies to renewable operators. However, the renewable development fund has been running on a deficit, resulting in a delay in subsidy payments.

The Ministry of Finance (MOF) released the “Report on the Implementation of the Central and Local Budgets in 2021 and the Draft Central and Local Budgets in 2022” on 13 March 2022, which was perceived to promote the solution to the funding shortfall in subsidies for renewable power generation. The report said that the budget expense of the central government fund in 2022 will be RMB 807 billion, +98.8% from the 2021 budget of RMB 406 billion and +101.6% from the actual spending of RMB 400 billion last year. Additionally, the NDRC, NEA, and MOF jointly released a notice on 29 March 2022 requesting all power grids and power generation companies to conduct self-review on their projects with grid connection to be eligible for tariff subsidy. Then on 11 May 2022, the State Council further announced that an extra RMB 50 billion would be paid by the People’s Republic of China (PRC) government to central government-owned power companies for renewable energy subsidies, on top of the amount previously allocated.

We view the above measures very positively for renewable energy generation companies as it will motivate further renewable power generation capacity capex.

We expect solar generation capacity in China to increase 46% yoy to 80GW in 2022. Over the first four months of 2022, solar generation capacity was up 138% yoy and new installations were 16.9GW due to a push back from 2021 installations to 2022.

1. Source: Mirae Asset estimates, June 2022

2. Source: Company’s data, June 2022

3. Source: Company’s data, June 2022

4. Source: Jinko Solar company data, June 2022

5. Hexagonal prismatic bipyramidal crystal (HPBC)

6. Passivated emitter and rear cell (PERC)

7. Heterojunction technology (HJT)

8. Source: Bid Center, June 2022

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.