THIS MATERIAL IS A MARKETING COMMUNICATION.

China Clean Energy: Q4 2022 Review

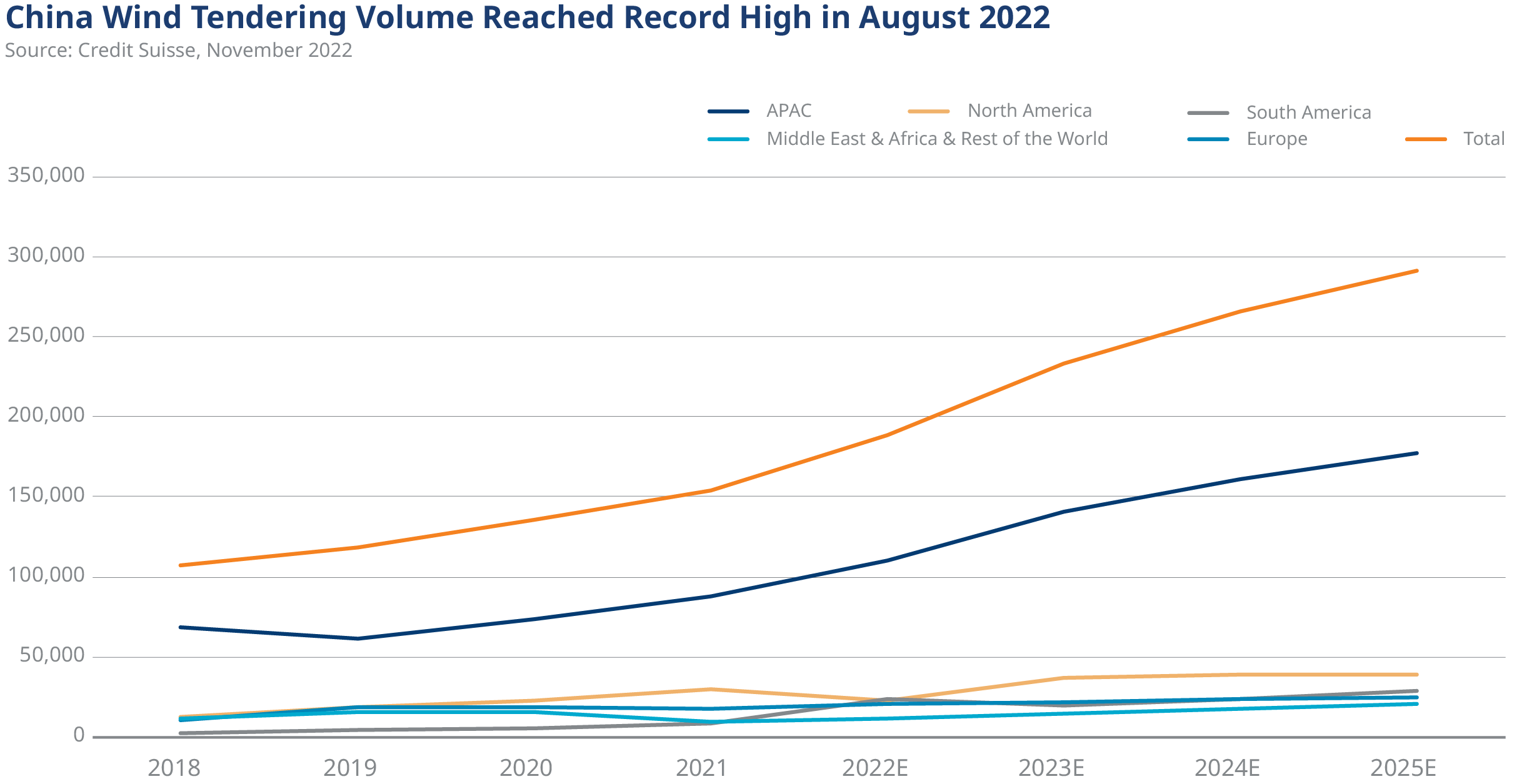

The sector’s attention weakened last quarter as the market became more focused on China’s macro and reopening trend. The revision of global energy prices drove less excitement about the clean energy sector than in the first three quarters of 2022. On fundamentals, we saw signs of polysilicon price correction in December, which could be a tailwind to solar installations in 2023. We also saw record-high wind tendering, which could start turning into actual installations after the recent reopening disruption. Looking ahead, we expect utility companies’ project returns to be favorable in 2023, as raw material costs will no longer be the main drag.

Keynotes

- Year-to-November solar demand growth globally was very solid, even as polysilicon prices stayed high. We started to see signs of polysilicon price correction, which could be a tailwind to solar installations in 2023.

- We see a continued focus on solar cell technology innovation to achieve better conversion efficiency and hence superior returns.

- Despite record-high new orders in 2022, reopening disruption slowed wind power installations in the recent quarter, but should pick up meaningfully in 2023.

Strong Global Demand Despite High Polysilicon Prices; Signs of Price Correction Starting December

Solar product prices have remained elevated for the majority part of 2022. Nevertheless, global solar power installation remains very resilient. In particular, China’s year-to-November installation was 66GW (+89% yoy), mostly led by strong residential and commercial projects.1 However, there were delays to China’s large-scale solar farm projects as they are more economically sensitive. Brazil contributed a lot, at 22GW (+83% yoy).2 India and some European countries, including Germany, Spain, and Italy, are also fast growing. The US market recorded 17GW by this September (-3% yoy) due to investors’ concerns from antidumping and countervailing duties (AD/CVD) investigation.3

Polysilicon shortage remains the key bottleneck for faster and more economical solar project installations. As new polysilicon supply began to come out in recent months and demand is soon entering a low season, we started to see signs of a polysilicon price correction in December. We saw successive prices cut along the solar value chain, starting from wafer, to cell, to modules, and finally to polysilicon. Solar module prices have dropped to a relatively low 12-month range of RMB 1.84 to RMB 1.90 per watt in December.4 Polysilicon prices dropped to RMB 240/kg by the end of 2022, with the lowest price quote dropping to RMB 185/kg.5 Hence, supply chain players are generally in a wait-and-see sentiment and face destocking pressure on concerns of a potential inventory impairment amid falling polysilicon prices. Industry channel checks suggest the supply of major raw materials along the solar supply chain should be sufficient next year. Thus, we believe polysilicon shortages will no longer be the main drag in 2023.

We are bullish on China’s demand uptick after solar panel prices decline. The large-scale solar projects, which are sensitive to project returns, should be most supported by the recent polysilicon price correction. Regarding the overseas market, the US government made a policy U-turn on solar panels in the middle of 2022 that should help boost future demand. It suspended tariffs for two years on solar panel imports from four Southeast Asian countries (Cambodia, Malaysia, Thailand and Vietnam) in which Chinese solar companies hold manufacturing capacity. This is to ensure that US consumers have access to a sufficient supply of solar modules to meet domestic electricity generation needs. We expect US solar demand may double in 2023 and maintain at high levels for a few years on the back of Biden’s supportive policies on US clean energy development.

Solar Cell Technology Innovation and Iteration Continues

With many different routes of solar technology being pursued by top solar makers, TOPCON technology commercialization was the clear outperformer in 2022. More company participation in TOPCON reinforces this trend and the research and development efforts. Ample equipment new orders have been placed for capacity expansion next year. Despite being on track for further cost reduction, HJT’s progress was considered to be falling behind as TOPCON efficiency improvement was beating expectations. We believe it is still early to determine which technology could be the dominant one to fully replace PERC. The most likely solution, in our view, is for cell makers to diverge in solar cell technologies for years before seeing significant conversion rate improvement and cost cuts in the mass production of some products. In addition, the current PERC capacities are quite new and concentrated in a few big solar companies, which are incentivized to fully utilize their PERC capacities before moving on to the next generation of technologies, even if they’re already ready.

Strong Wind New Order Appetite; Actual Installations Delayed due to Reopening

China’s 2022 wind project new order growth was exceptional. Full-year tendering volume for wind projects could reach 100GW, which was a record-high number, compared to just 65GW in 2019.6 Among these, 15GW comes from offshore wind projects. Despite the strong new order growth, actual installations in 2022 have yet to pick up, causing major disappointments in recent quarters, partly due to lockdown disruptions and design optimization to cater to larger-sized wind turbines. Q4 was often the strongest season for installations in the past, but this year, installations could be delayed to 2023 due to China’s reopening disruption in November and December. With record-high new orders growth, we expect installations to pick up meaningfully in 2023.

From a profitability standpoint, we believe the correction in container freight rate and raw material costs to be a positive tailwind for the wind supply chain in 2023. These help alleviate cost pressures and improve the margin outlook of the whole wind supply chain. This, together with strong new orders, leaves a higher profit pool to the market players and hence relatively less intense price competition. The upcoming installation acceleration is a positive catalyst, particularly favoring component suppliers whose profits depend on volume delivery and capacity utilization.

Source 1: Haitong, December 2022

Source 2: Ibid.

Source 3: Ibid.

Source 4: UBS, December 2022

Source 5: UBS, December 2022

Source 6: Credit Suisse, December 2022

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.