THIS MATERIAL IS A MARKETING COMMUNICATION.

New Trends of Chinese Real Estate

New home sales in China have been growing for the past two decades and floor area per capita has surpassed 30 square meters1; similar levels to those seen in developed countries. However, in recent years we have witnessed its slowdown with government’s message of “housing for living, not for speculation”. It is no surprise that investors will question what new trends will emerge and which industries are likely to benefit from the new normal. This report will attempt to address these questions.

A Growing Secondary Residential Market

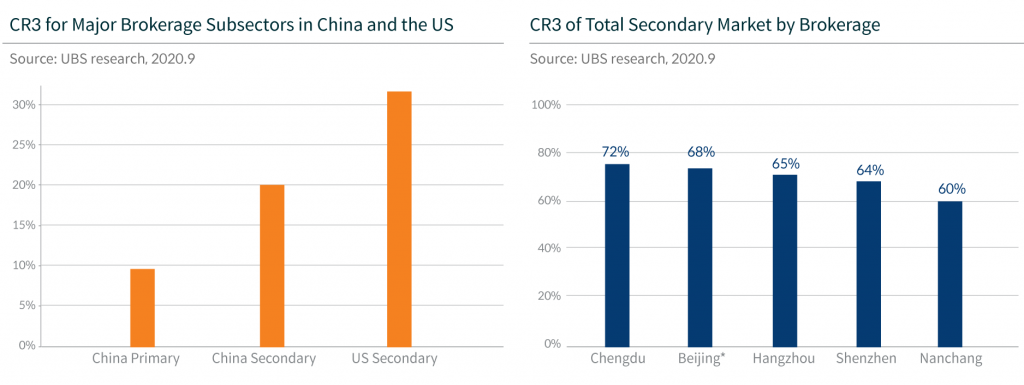

As shown in Exhibit 1, new home sales increased from 6.2 trillion to 13.9 trillion during 2014-2019 with a Compound Annual Growth Rate (CAGR) of 17.5%. Since 1998, over 17 billion square meters2 of commercial housing sales has created a huge secondary residential market, especially in first tier cities with limited land supply. Exhibit 2 shows that for many years, secondary residential sales have been higher than new home sales in Beijing and Shanghai. Limited space in high tier cities, especially in downtown areas, coupled with population of urbanization and industrialization, will naturally lead to a growing number of secondary home transactions. Home sales by brokerage should benefit from the trend as a result. Exhibit 3 shows penetration in existing home sales is at a very high level of 88%. In the past few years, it has continually extended to new home selling and rentals. Despite this, the real estate brokerage market in China is still very fragmented. In 2018, CR33 for primary/secondary brokers was 9%/20% respectively, compared to 32%4 for US secondary peers. Therefore, we believe, that real estate brokerage can potentially break away from mature property markets and sustain long-term growth in the foreseeable future.

Property Consolidation, Decorative Housing5 and Prefabricated Construction Drive Concentration in Downstream Industries

Leading developers have been gaining market share for years as we discussed in the previous article. China has initiated policies to raise the penetration of decorative housing / hardcover6 to replace the current mainstream concept of bare shell housing. This is aimed at increasing the proportion of pre-fabricated construction in construction sites for the purposes of reducing labor and environmental reasons. The factors work in the same direction to stimulate downstream industries in terms of consolidation, including construction materials like waterproofing and coatings, and housing-related consumer discretionary industries such as home furniture and decoration. For example, in waterproof materials industry, property developers’ centralized procurement in a nationwide strategy benefit leading waterproof manufacturers. These manufacturers have a range of capacities and have subsequently been gaining market share in each region against local players post policy release. This has in turn helped with cost advantages for national-level developers and contributed to the developer-end consolidation; although only to a small extent. We also see from Exhibit 7 and 8 that new launches of pre-sale furnished homes enjoyed solid growth in the last five years while the home decoration industry has increased consolidation with a sharp drop in the total number of decoration enterprises. Exhibit 10 shows the penetration rates of key parts/materials required for decorative properties. There are still many industries with a low penetration rate and in the past were extremely small compared to the size of the Chinese property market. However, we believe they are emerging into a positive growth outlook and are becoming increasingly attractive as the latter slows down.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.