THIS MATERIAL IS A MARKETING COMMUNICATION.

Electric Vehicles Industry Review and Outlook

Government policies and stimulus packages have been the key driver to push battery electric vehicles (BEV) adoption in the last decade. Governments worldwide, in particular EU and China, have been tightening their carbon emission policies, especially in the last few years. Meanwhile fast technology innovations have made electric vehicles (EV) more consumer-friendly with battery cost falling from US$700/kwh in 2015 to US$150/kwh in 20191. Original equipment manufacturers (OEMs) have been looking for a way to better balance production cost and consumer utilities. For example, BYD’s blade battery and CATL’s cell-to-pack (CTP) technology have largely increased energy density of Lithium Iron Phosphate (LFP) batteries and their driving range, enabling EVs with LFP batteries to be used for intra-city public transportation. As a result, more and more OEMs are equipped with cheap LFP batteries. EV sales have witnessed a significant increase this year, after a hiccup in 2020 due to covid-19. We expect more auto makers to launch new EV models in the second half of 2021 and 2022 in major countries such as China, the US, Germany, Japan and Korea, as shown in Exhibit 2. Coupled with continuous development of charging stations, smart parking areas and other infrastructure facilities, consumers will likely become more interested in EVs, which will accelerate EVs’ penetration pace.

In addition, we believe EVs are able to reach cost parity with traditional internal combustion engine (ICE) passenger cars in the next five years as 1) EV technology innovation keeps reducing component cost, 2) auto OEMs will gain economies of scale with rising EV shipments, 3) there will be co-operation between auto OEMs, battery makers and part makers.

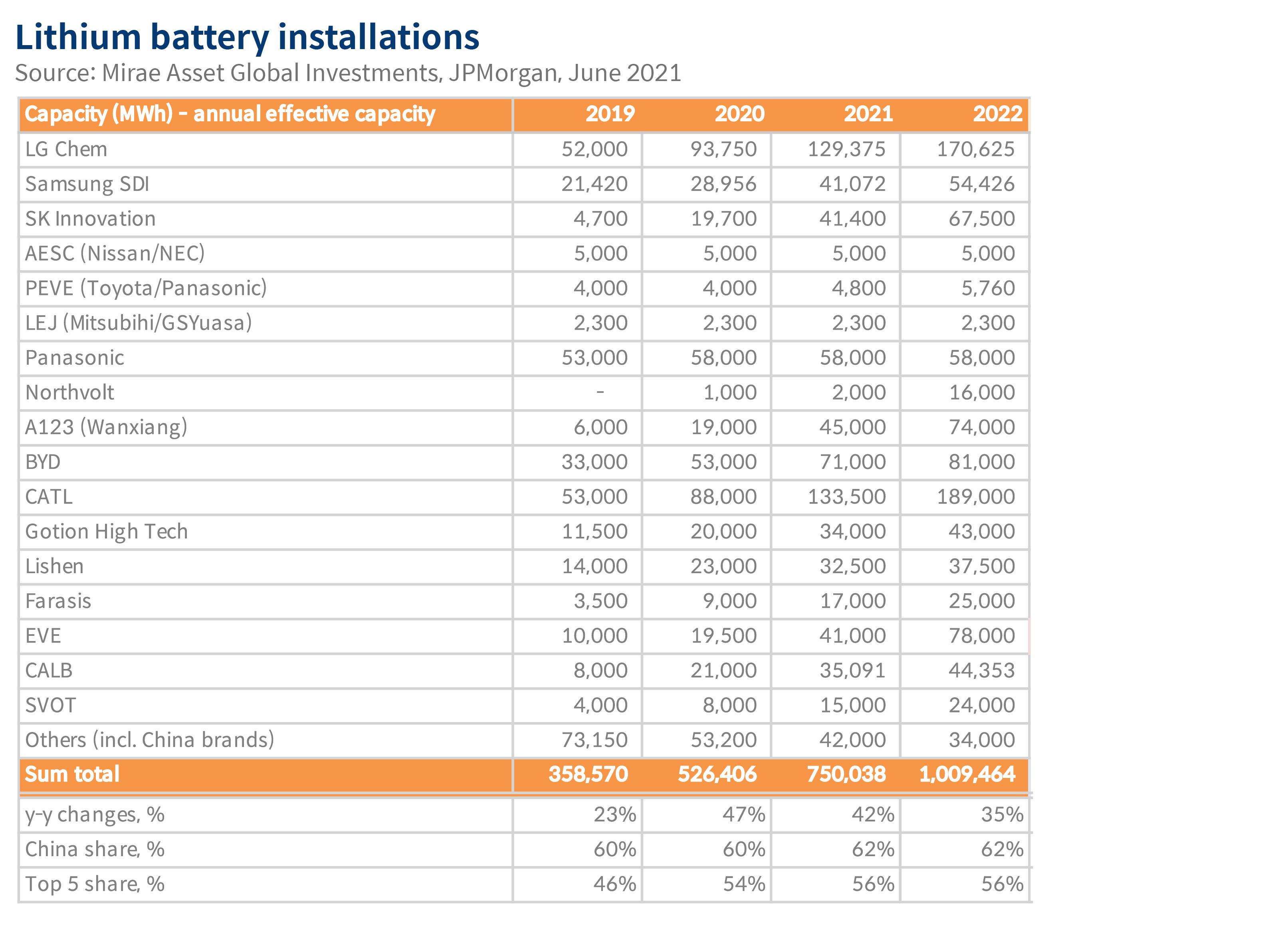

We are optimistic about long-term EV demand and cost decline. Global auto sales are stable around 80 million units for years, among which EU, China and the US are the top three contributors. We expect EV sales to accelerate in the next five years providing that EU and China are actively promoting EV adoption, the US rejoined the Paris Agreement and EV products become more and more cost competitive. China accounts for almost one third of global auto sales and half of global EV sales2. China domestic EV OEMs have first mover advantages in adopting smart EV technologies to some extent, and cost advantages due to synergy with local battery and auto part makers. However, competition has just began as traditional auto makers are ready for transition from ICEs to EVs. Leading ICE makers are likely to gain market shares, which will increase the invisibility of competition landscape. Therefore, we prefer EV battery names to OEMs, especially those with technology or cost advantages in the long term.

1 Source: Bernstein, March 2020

2 Source: Mirae Asset Global Investments, June 2021

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.