THIS MATERIAL IS A MARKETING COMMUNICATION.

The Future of the Booming Solar Power

Solar installation in major countries recorded a high single-digit growth by the end of September, missing the expectation at the beginning of the year but much better than that in the worst time post covid-19 outbreak. Going forward, regarding the demand side, China, as the largest solar market in the world, is proactively taking more responsibilities in carbon emission reduction though they will cancel subsidy for utility-scale solar projects in 2021. The US is exposed to great solar resources and expects to see more solar demand as Joe Biden has won the election. India used to be the third-largest solar market but is significantly affected by covid-19 in 2020. Covid-19 also impacted some other major markets more or less, such as Europe, the Middle East region, and South America. We expect a moderate recovery in the regions post covid-19.

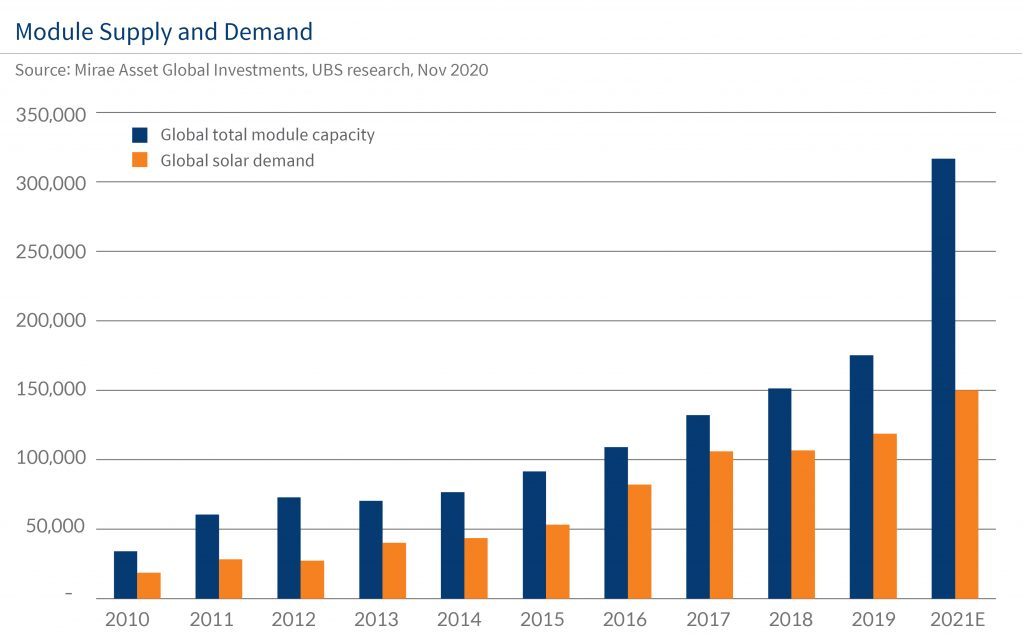

Supply-side is more visible than demand. The below graphs show the effective capacities in each part along the major solar supply chain in 2021. The supply and demand balance in the polysilicon end is likely to improve next year with the top five producers taking a total market share of over 2/3. Consolidation in wafer part is decelerating with the top 5’s total market share of nearly 80% next year. Wafer oversupply will probably take place in 2021, while the realized price depends on demand as well as how many effective capacities are put into operation each quarter. More capacities from second-tier wafer players, module makers, and wafer equipment producers will come out by the end of 2021. New capacities are mainly for M10 (182mm x 182mm) and M12 (210mm x 210mm) silicon wafer, while the latter needs time to show the efficiency. A solar cell is fast-changing and less profitable in the solar supply chain. Technology plays a vital role in competitive landscape dynamics but is quite stable in a medium-term cycle. Thus, wafer makers and module players keep entering into cell production now to improve supply chain stability as well as margins. We can see in the graph below that Longi has added over 15GW of solar cell capacity in the last two years and ranked No.3 by 2021, followed by integrated solar materials makers like Jinko Solar and JA solar. After all, the solar cell is an intermediate part, driven by the downstream demand. That is, module makers and their sales channels determine the solar cell competition advantages within a technology cycle to some extent. Consolidation in module end is accelerating with the top 10 makers’ total market share increasing from 57% (2020E) to 64% (2021E). Most of the leading module players are adding capacities and building up sales channels in the coming years. It will highly impact the demand for cells and even wafers.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.