THIS MATERIAL IS A MARKETING COMMUNICATION.

The Future of Camera Technology

In this article, we will explore the latest development in camera technology, as well as key players in the industry.

Significance of Camera Technology

Cameras are the eyes of computers. The development of our ability to process and apply vision data has come hand in hand with the advancement in camera technology. The relationship between hardware and software in camera technology is no longer detached. Miniaturisation, high definition and other innovations in camera technology have allowed us to collect vision data in areas and ways that were not possible before. This opens up opportunities for applications in smartphones, autonomous vehicles, healthcare, surveillance and more.

Smartphone has been a key driver of the advancement of camera technology. Its high volume and per-device value provide resources and incentives for innovation. Smartphone camera accounts for 82% of the overall CMOS (Complementary metal-oxide-semiconductor) image sensor market (Techno 2020). Research institution Yole Développement forecast the overall revenue of the global camera module market to grow from US$31.3 billion in 2019 to US$57 billion in 2025, representing a 10.5% CAGR (compound annual growth rate).

Vision is one of the most important data inputs for autonomous driving. Having a reliable, high-performance camera system is crucial to the success of autonomous driving. We see two mainstream combinations of core sensors in developing an autonomous system. The first one is a combination of LiDAR (light detection and ranging), RADAR (radio detection and ranging) and Camera. The second solution is a combination of just RADAR and cameras, with visual data being the primary input to the system adopted by Tesla. Note that the majority of camera components are also used in a LiDAR.

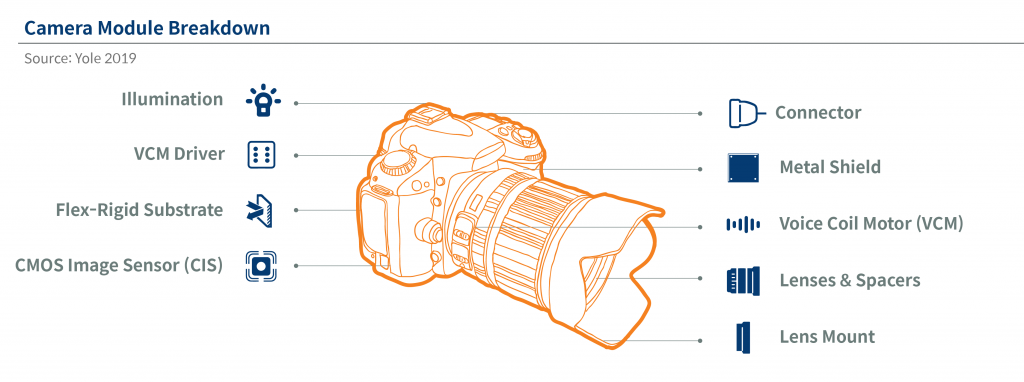

Key Components of the Camera Module

- Image Sensor - The image sensor converts the variable attenuation of light waves into electronic signals. The two main types of digital image sensors are charge-coupled device (CCD) and active-pixel sensor (CMOS sensor).

- Lens Set - Camera lens gathers and focuses the light reflected from a scene or subject. As the reflected light rays enter camera lens and pass through the elements, they are directed to the camera's image sensor.

- Module - Camera module holds all the components together, protect the lens set and image sensor.

- Others - The camera module also has other components like Printed Circuit Board (PCB), Voice Coil Motor (VCM), filter, connector etc.

Source: Mirae Asset 2020, Sony 2020, Oppo 2020

How Far Can Camera Technology Evolve?

We believe camera technology will continue to innovate, given the importance of vision in machine intelligence. We highlight three key technological developments in the industry below which we think will shape the future of camera technology.

Time of Flight (ToF) Camera – Mid-Long Distance 3D Sensing Capability

A time-of-flight camera (ToF camera) is a range imaging camera system that employs time-of-flight techniques to resolve distance between a camera and a subject for each point of the image, by measuring the round trip time of an artificial light signal provided by a laser or an LED. Companies are able to adopt structured light technology in the front-facing camera of a smartphone, which enables accurate and secure facial recognition application. Incorporating ToF camera in the rear-facing camera of a phone will allow more precise measurement of mid-long distance 3D imaging for better portrait mode and Augmented Reality (AR) applications.

Multi-Camera Trend – Improving Versatility

Since smartphone lenses are fixed, the only way to have lenses for a different purpose is to put multiple camera lenses, say telephoto lens (for high optical zoom), ultra-wide lens, and specialized video camera etc., on at the same time. The multi-camera trend has been developing for several years. We expect the functionality of these cameras to improve continuously going forward.

AI Camera-Image Processing Closer to Sensing

Artificial intelligence enables a wide range of possibilities in applying vision data, such as autonomous driving. Requirement for lower latency and faster image processing brings computation closer to sensing module (camera module). Sony launched the next generation CIS (CMOS image sensor) earlier this year (IMX 500, 501), and the sensor packaged a logic chip under the pixel chip. Signals acquired by the pixel chip are run through an ISP (Image Signal Processor) and AI processing is done in the process stage on the logic chip while the extracted information is outputted, reducing the amount of data handled.

Camera Supply Chain – Key Players

Sony – Image Sensor

Sony is the largest image sensor producer globally with 48% market share by revenue in 2019 according to techno system research (2020). It is a leader in high-end sensor, as Sony collaborates with top tier smartphone brands to develop high-end customized image sensors.

Samsung Group – Image Sensor, Camera Module, Lens, Actuator

Samsung is the second-largest image sensor provider globally. SEMCO (Samsung Electro-Mechanics) also designs and manufactures key components such as lenses and actuators, and produces camera modules for mobile and auto applications.

Will Semi – Image sensor

The company acquired OmniVision (OV) in August 2019. OV is the third-largest CIS design house with around 10% market share in the overall CIS market in FY19. (Techno system research 2020).

On Semi – Image sensor

On Semi is a key image sensor supplier in the auto industry. It has over 60% market share in auto CIS in 2018 (HIS 2019).

Largan Precision – Lens

Largan is a leading provider in camera lenses for consumer electronics. The company focus on supplying high-end lenses.

Sunny Optical – Lens, Camera Module

Sunny optical provides both camera lenses and camera module assembly for consumer electronics and autos. The company has also been working with LiDAR suppliers to supply optical components.

Source: Mirae Asset 2020

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.