THIS MATERIAL IS A MARKETING COMMUNICATION.

Global Electric Vehicle & Battery Review 1H22

Sector trend

Global electric vehicle (EV) sales remained solid in the first half of the year despite growing concerns of global economic slowdown, customer affordability after EV price hikes, and covid-19 resurgence in China which led to lockdowns in Shanghai in April and May. EV penetration in China, Europe and the US has been accelerating on the back of surging oil prices and energy crisis (Exhibit 1). On the policy front, China announced auto purchase tax cut to stimulate auto sales. An increasing number of local governments have joined to provide subsidies for auto purchase or replacement, especially for electric vehicles.

Despite strong end demand for EVs, supply constraints remained throughout

Higher global EV penetration year-to-date is forcing companies, including car makers and component suppliers to accelerate their EV transition (Exhibit 3). With current high energy prices, the total cost of ownership in the US is lower for hybrid EVs and battery EVs, compared to gasoline-powered vehicles, especially with tax incentives.1 The launch of new EVs by automakers around the world, and front-loaded demand in anticipation of further price hikes for EVs have also supported this structural transition.

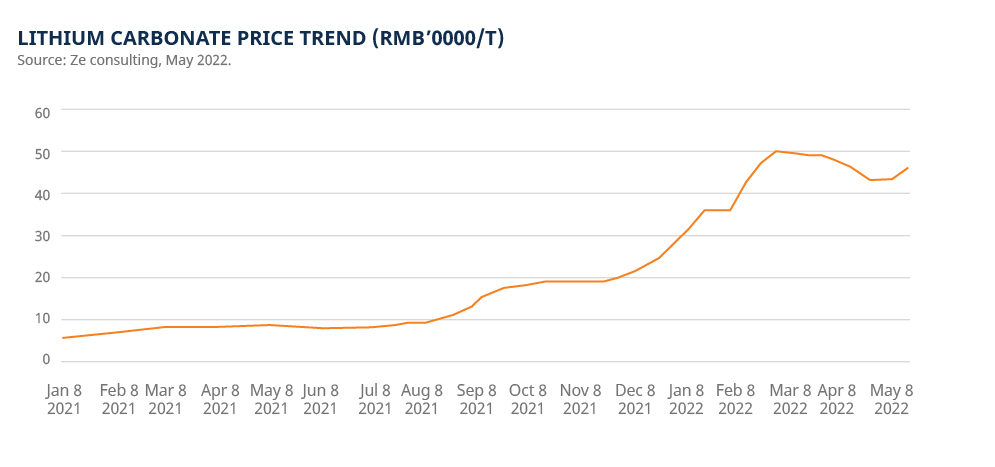

Commodity price inflation was another key focus during

Market outlook

We believe electric vehicle sales in China will remain strong till the end of the year on the back of national and local stimulus policies. Consumers will likely shift their car purchase decision earlier to this year when favorable policies are still available, which means we may see a deep decline of sales in 2023 if subsidy exits. The good news is that an extension of subsidy or purchase tax exemption is under discussion at present.

For the US and Europe EV sales, while the current situation is more favorable to EVs compared to gasoline-powered vehicles due to high energy prices, the global economic slowdown could damp auto purchase interest. According to a survey conducted by the University of Michigan in May, consumers expressed record low sentiment toward the purchase of a new vehicle, citing high prices and rising interest rates.

It could be difficult for battery makers in the next twelve to eighteen months. Cost inflation pressure may ease after Q3, but competition will become more fierce since most of the major players have announced aggressive expansion plans for the next three years. Some claimed their new capacities are backed by orders from major OEMs and they are cost efficient thanks to integrated supply chain. However, gross margin declines in 1Q22 showed that they did have difficulties passing cost to OEMs.

Staying Ahead with Mirae Asset’s Latest Insights

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.