THIS MATERIAL IS A MARKETING COMMUNICATION.

Implications and Opportunities of ChatGPT

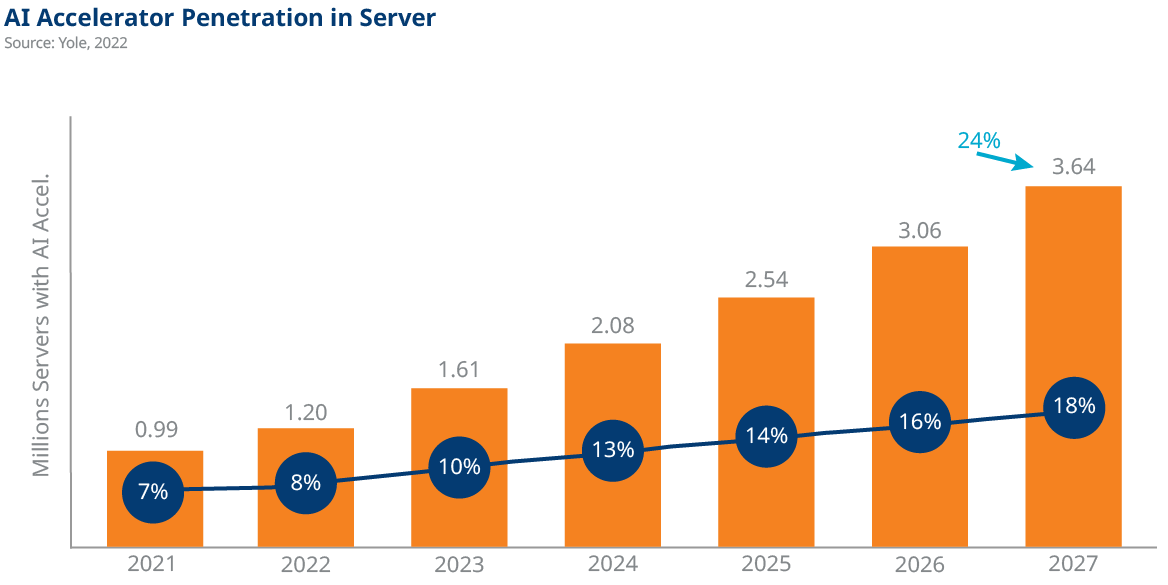

The success story of ChatGPT’s commercialization led to great expectations that artificial intelligence (AI) technology will create lucrative new business models and nurture lots of new tech companies. Meanwhile, its development will need lots of semiconductors. For reference, AI accelerator penetration is expected to grow at a compound annual growth rate (CAGR) of 24% between 2021 and 20271. This will benefit Asia and China’s high-performance computing-related semiconductor supply chains.

Q: What is Generative AI?

Generative AI describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, videos, etc. ChatGPT is the latest natural language model launched by OpenAI and trained on Microsoft Azure’s supercomputing infrastructure. The model is trained using Reinforcement Learning from Human Feedback (RLHF). ChatGPT is tuned from a model in the GPT-3.5 series, which finished training in early 2022.

Q: What Potential Business Models Could Spawn from Generative AI?

1. Support other products built on an application programming interface (API): Companies which own large AI models can provide API services for other companies to build software/applications on top of its model and cloud services. Currently, services are priced per word/image. For example, a high-resolution image output of 1024x1024 pixels generated by DALL.E (Open AI’s image model) costs $0.02/image2.

Hyperscale cloud service providers all offer different versions of AI capabilities. For example, Google Cloud and Amazon’s cloud both provide AI capabilities as API services. Differentiating factors will be in the type of tasks and capabilities of the model itself. As a result, there are ample opportunities for companies to innovate with access to large AI models via API.

It’s likely that GPT models can be leveraged by metaverse builders to help generate content and write code. More specifically, GPT can produce interactive features and representations of virtual settings within metaverse worlds and provide more immersive experiences to users if specifically trained for virtual settings.

2. Search: Google works by crawling billions of web pages, indexing that content, and then ranking it in order of the most relevant answers. It then spits out a list of links for the user to click through. ChatGPT offers a single answer based on its own search and synthesis of that information. OpenAI is working on a system called WebGPT, which it hopes will lead to a more accurate answer to search queries and also include source citations.

Q: How Advanced Are China’s AI Capabilities Compared to Developed Markets Like the US?

In the past decade, China has built a solid foundation to support its AI economy and made significant contributions to AI globally. China ranks number one in terms of the total number of AI-related research papers. AI research often leads to real-world applications, which we’ve seen rapid growth in China.

According to Nikkei Asia, China produced 43,000 AI papers in 2021, roughly twice as many as the US, and contributed to one-third of AI journal papers worldwide3. According to Stanford University’s AI Index Report (2020), China has also surpassed the US regarding the share of AI paper citations4.

Today, AI adoption has started to prevail in many industries including finance, retail, and high-tech. The Chinese government has already released supportive policy guidelines to foster investments in AI-related fields.

Q: Are There Any Generative AI Engines Developed by Chinese Companies?

Baidu is positioned to be one of the leaders in generative AI in China. Baidu has had an early start on AI technology, particularly on natural language processing (NLP), given the close synergy to its core search business. According to the company, Baidu’s own generative AI product, ERNIE Bot, is expected to complete beta testing and be open to the public in March 20235. The underlying model of ERNIE 3.0 fuses an auto-regressive network and an auto-encoding network. Hence, the trained model can be easily tailored for both natural language understanding and generation tasks with zero-shot learning, few-shot learning, or fine-tuning.

Besides Baidu, companies like ByteDance, Alibaba, and Tencent also have the potential and have shown ambition to develop generative AI, given the sheer amount of data these companies have on hand. ByteDance has always utilized algorithms to analyze user preferences. Therefore, content generation using AI technology, whether for text, image, or video format, could blend in naturally with its existing businesses. Additionally, the development of generative AI could help improve the overall monetization/pricing opportunities for Baidu, Alibaba, and Tencent’s cloud services.

Given the amount of computing power required and the significant cost associated with each time a model is trained and updated, large companies with a deep bench of cash on hand, in our view, will be better positioned to tap into this field.

Q: Does China Have Any Unique Competitive Advantages in this Space?

First of all, most of the AI applications that have been widely adopted in China to date have been in consumer-facing industries like internet, propelled by the world’s largest internet user base. Internet platforms have seen phenomenal growth over the past decade, underpinning a strong investment cycle for cloud computing-related infrastructure. This has set a good foundation in terms of computing power, data, and training models required for AI development.

Secondly, China’s comparative advantage lies in its huge engineering talent pool. Tertiary attainment ratio among 18–22 years-old rose from 10% in 2000 to 49% in 2019. The large pool of engineers, especially software engineers, will continue to support strong growth in AI development.

Q: Which Sectors Across Asia Will Benefit the Most from Generative AI?

Asia and China’s semiconductor industries should benefit from the infrastructure investment required for generative AI. The development of advanced AI models and the ensuing blossom of new products will require significant investment in computing power to support its operations. Yole projects AI accelerator penetration to increase from 8% in 2022 to 18% in 2027, representing a CAGR of 24% from 2021 to 20276. This will benefit Asia and China’s high-performance computing-related semiconductor supply chains, including:

- Asia foundries. An increase in demand for AI accelerators (i.e. GPU, ASIC7) will benefit the foundry industry, as most AI accelerators are produced by fabless, which relies on foundries to produce their chips. Asian foundries have over 90% market share globally8.

- Design service and integrated circuit (IC) design companies. There are a number of companies in Asia that provide design services for ASIC chips in AI accelerators. MediaTek, for example, has an ASIC division focusing on high-performance computing.

- Memory. AI and machine learning (ML) applications will demand better memory performance and more bits.

- Equipment makers will also benefit from the strength in semiconductor demand driven by AI-related workloads.

1Source: Yole, 2022

2Source: OpenAI, February 2023

3Source: Nikkei Asia, January 2023

4Source: Standford University, 2020

5Source: Baidu, February 2023

6Source: Yole, 2022

7Graphics processing unit (GPU), application-specific integrated circuit (ASIC)

8Source: Trendforce, 2022

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.