THIS MATERIAL IS A MARKETING COMMUNICATION.

China: the Road to Autonomous Driving

Autonomous driving is one of the most exciting fields in the next decade. Breakthrough in Artificial Intelligence (AI), build-out of 5G network and advancement in semiconductor technology are leading us closer to full automation.

In this article, we will introduce the value chain in autonomous driving and key Chinese players in this industry.

Industry Overview

To discover investment opportunities around autonomous driving, we must first understand the basic architecture and key players in each segment. A complete system requires intelligence at three locations, namely on the vehicle, at the edge (roadside, proximity to the vehicle) and in the cloud. Most automakers work with industry partners to develop capabilities on the vehicle. Telecom companies and cloud infrastructure companies are working to build the infrastructure at the edge and in the cloud to support the autonomous driving system.

Levels of Automation

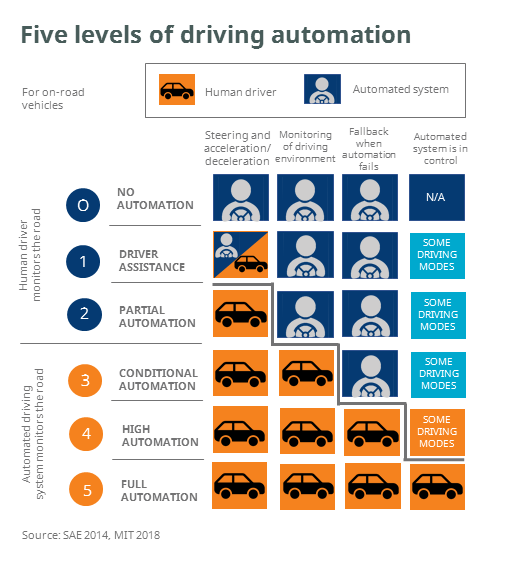

The Society of Automotive Engineers (SAE) identified six levels of driving automation from ‘no automation’ to ‘full automation’. Human drivers are considered to monitor the system in level 0-2, while the system is in-charge above level 3. Level 5 represents full automation with no human driver attention required.

On the Vehicle: Automakers

Domestic automakers work closely with industry partners to launch L3 autonomous driving vehicles in 2020-2021. We see collaboration across the entire system architecture from the vehicle, edge to cloud with multiple partners, which shows the complexity of an autonomous driving system. We think the initial trial will be conducted in closed roads and controlled environment. For example, SAIC motor is working with Shanghai International Port Group, Huawei and China Mobile to launch a 5G smart traffic demo area in Yangshan port in Shanghai. L4 autonomous trucks with 5G connectivity are being tested in this area.

Sensing

Autonomous vehicles require sensing components to collect vital environment data and vehicle data. Core vehicle sensing components are expected to be a US$77Bn market globally by 2032, according to Yole. We see two mainstream combinations of core sensors in developing an autonomous system. The first one is a combination of LiDAR, RADAR and Camera adopted by companies like Waymo, Baidu, AutoX etc. LiDAR generates redundant surrounding information which needs to be analyzed in parallel with visual data from the camera. However, LiDAR can operate in challenging lighting conditions and generates precise 3D measurements. The second solution is a combination of just RADAR and cameras, with visual data being the primary input to the system adopted by Tesla. As computer vision technology improves, companies like Tesla can rely on visual data collected via cameras to complete the system.

Perception and Decision

The key to autonomous driving is the on-board algorithms. Vehicles need to be able to understand, predict and act based on information from sensing modules, network and on-board computers. AI techniques such as machine learning are used to train different models to achieve those tasks. Baidu, Pony AI, AutoX are some of the Chinese companies, focusing on autonomous driving algorithms. Companies like NavInfo and Autonavi provide high-precision map to support the system. On the hardware side, Horizon robotics is developing chips for autonomous driving.

Edge: Internet of Vehicles – Commercialize Cellular Vehicles to Everything (CV2X)

CV2X is a communication network, leveraging on 4G and 5G technologies to apply to vehicle communication. Vehicle communication with other vehicles, infrastructure and network is crucial to achieving a high level of automation and safety. The roll-out of global 5G standards includes specifications around CV2X network. The Chinese government published Strategy on Innovations Development Intelligent and Connect Cars in February 2020, targeting regional coverage of 4G-V2X and key cities as well as highway coverage of 5G-V2X network by 2025. China Securities expects the total size of C-V2X roadside infrastructure investment to be RMB 62.8Bn between 2022 and 2025. Huawei, Datang Telecom, ZTE, Alibaba, Nebula Link, Neusoft, NavInfo, Wanji Technology and SureKAM are some of the domestic players in this area.

Cloud

Given the large size of data set and significant amount of computational power required to train the autonomous driving system, hyper-scale cloud companies provide driving data, training and simulation services that help companies accelerate the development of autonomous driving products. The main Chinese companies in this area include Huawei, Alibaba, and Tencent. Huawei, for example, launched the Octopus cloud service in 2019, targeting to serve autonomous driving developers.

Outlook

The autonomous driving industry is a complex ecosystem, and the road to full automation requires collaboration across industries and countries. Chinese companies are making progress in setting the basic framework for the development of an autonomous driving system, and the Chinese government has also been aggressive and supportive in pushing the technology forward. We think the development in this area will accelerate as the role of each company becomes clearer.

Staying Ahead with Mirae Asset’s Latest Insights

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.