THIS MATERIAL IS A MARKETING COMMUNICATION.

Growing E-Commerce with Livestreaming

As internet infrastructure continues to advance, China’s livestreaming industry has been developing at an unprecedent speed. Livestreaming is now fully embraced by many internet verticals including online gaming and e-commerce. Advanced internet infrastructure has also lowered the entry barrier for livestreaming, and the total number of livestreamers is growing substantially.

Game Livestreaming

China has the largest gaming population in the world with over 700 million participants (based on our estimates, as of Dec. 2020). Growth in player engagement has brought eSports and game livestreaming to the mainstream. The wide adoption of bullet chats and virtual gifts makes interactions between viewers and streamers prominent in China. The total industry is expected to grow to Rmb49.7 billion by 2022E (according to iResearch, July 2020).

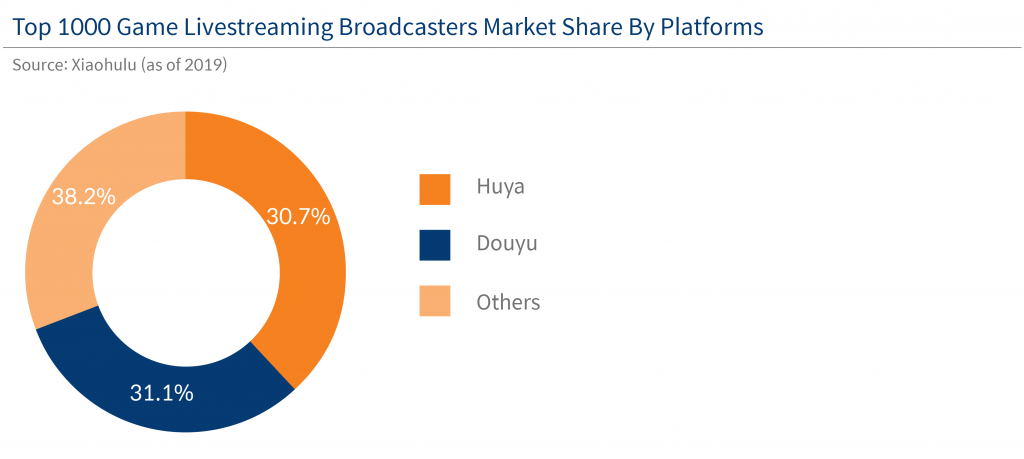

The two major game livestreaming platforms are Huya and Douyu. Tencent holds a stake in both companies which play vital roles in online game ecosystem with a full library of gaming resources (gaming cohorts, streamers, eSports tournaments, community) that maintain gamers' engagement and extend the longevity of games. It was reported last June that Tencent was considering a merger of Douyu and Huya and the deal was expected to be completed in 1H21 (according to Huya management, Morgan Stanley China Internet Seminar Dec. 2020). The merger could further help generate synergies between the two platforms in terms of content generation and cost savings and thus create a more benign competition landscape.

In our view, the core competitiveness of both new and existing game streaming platforms is the ability to preserve talent, as traffic on game livestreaming platforms tends to highly concentrate on top streamers. To attract top ranked streamers, livestreaming platforms have signed exclusive contracts (as per annual report 2019) and shared 50+% of virtual item sales with these broadcasters (according to company prospectus, revenue sharing ratio was 50.2% in 2017, which we expect to main similar level in recent years).

E-commerce Livestreaming

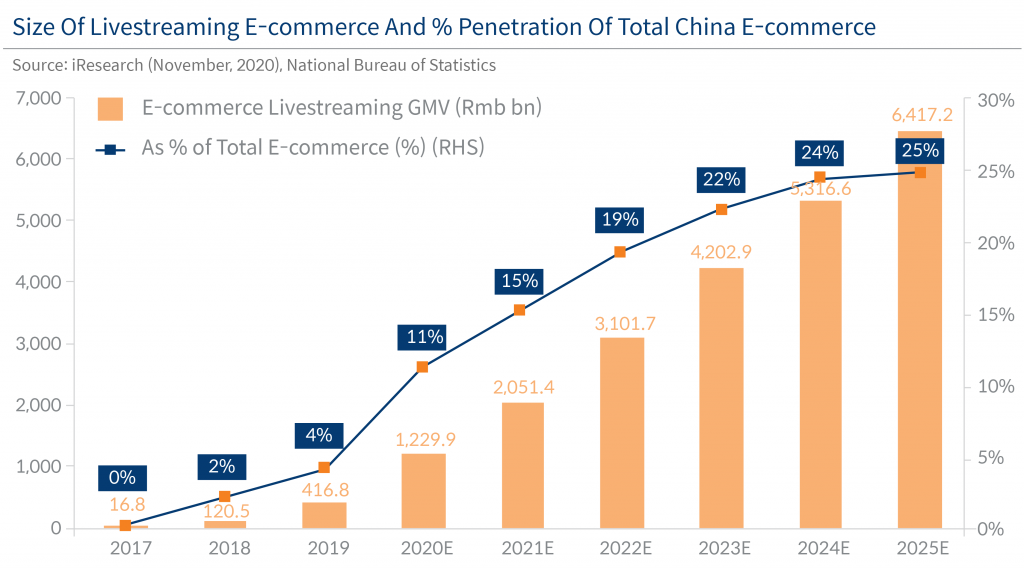

E-commerce livestreaming first emerged in 2016 as an interactive way to sell products to consumers. According to iResearch (Nov. 2020), the total GMV (gross merchandise value) of livestreaming e-commerce will grow at a compound annual growth rate (CAGR) of 39% in the next five years, reaching Rmb6.4 trillion (~US$1tn) by 2025E, accounting for 25% of total e-commerce sales in China. Taobao, Douyin and Kuaishou will remain the three dominant players with ~80% market share (2025E).

As of December 2020, more than 90% of level-1 category merchants on Taobao had been involved in livestreaming, and the total sales through livestreaming reached Rmb72.9 billion during the Double 11 Shopping Festival in 2020 (according to Taobao Livestreaming), which was 15% of the total sales on Taobao during the same period. For Taobao, 90% of livestreaming is performed by merchants, only ~10% by Key Opinion Leaders. (Taobao, Bernstein analysis, July 2020). However, on Douyin and Kuaishou, most livestreaming is conducted by KOLs as traffic is concentrated at the top.

We think the increasing popularity of livestreaming e-commerce:

is a natural result of rising mobile time and evolving consumer behaviors. As users spend more time on online shopping, it has become a more entertaining and interactive experience;

helps consumers make their purchase decisions amid the explosion of available products online and

provides value to merchants as an effective way to attract, connect, and interact with consumers. Livestreaming also helps merchants sell large volumes of limited stock keeping units (SKUs) in a short period of time, leveraging the influence of that have large number of fan bases with strong purchasing power.

There’re currently three types of livestreaming e-commerce, namely KOLs, brand, and platform-based livestreaming.

Currently there are more than 1 million livestreamers (as of end-2019, as per on Taobao, according to Alibaba. Competition is intense, and traffic is highly concentrated on top ranked KOLs. Taking Double 11, 2020 for an example, the total GMV generated from livestreaming was Rmb72.9 billion, among which more than 40% was from Top 10 KOLs. (Dolpin Haitunzhiku.com, November 2020) The Top 10 KOLs have very strong bargaining power in price negotiation with brands to make sure that products sold through their sessions are the cheapest to generate more orders. They also request lower revenue share with platforms due to large GMV contribution.

Regulation Headwinds

On November 23 2020, the NRTA (National Radio and Television Administration) issued a notice which requires platforms to check the quality of products sold via e-commerce livestreaming, and limit the amount of money that can be "tipped" by viewers to channel hosts by day/month. According to Morgan Stanley Research (November 2020), virtual gifting revenue could have amounted to Rmb150 billion in 2020E, with the top 2% users contributing 75% of the revenue (over 2,700 users tip >Rmb1 million/year). In our view, these regulations could curb virtual item sales on major livestreaming platforms and put 2021 revenue growth under pressure.

Staying Ahead with Mirae Asset’s Latest Insights

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.