THIS MATERIAL IS A MARKETING COMMUNICATION.

Infrastructure-As-A-Service (IAAS) in China

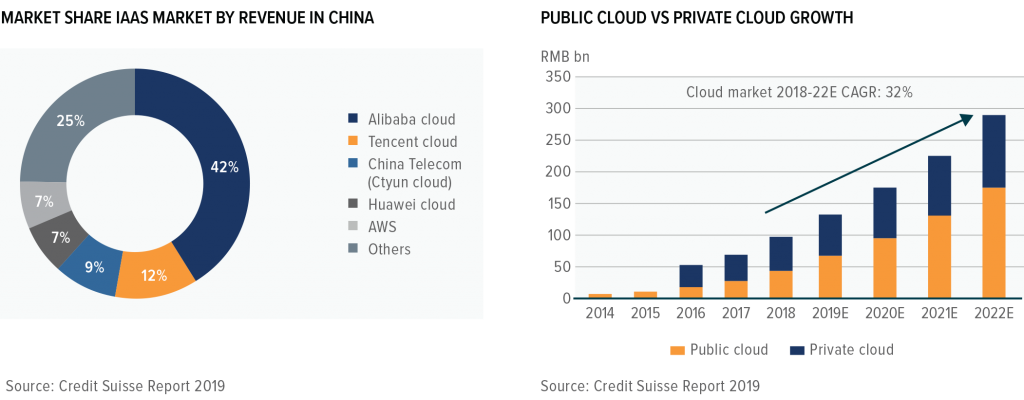

According to the Ministry of Industrial and Information Technology (MIIT), the cloud market in China is expected to grow at a Compound Annual Growth Rate (CAGR) of +32% for 2018-2022E, reaching RMB 290bn (US$41bn) in 2022. The public cloud is estimated to reach a 60% share of the total cloud market by 2022 from 40% in 2018.

Within the cloud market ecosystem, Infrastructure-as-a-Service (IaaS) provides the most fundamental basic services, including server/storage, networking, and Information Data Centre (IDC) / Content Delivery Networks (CDN) services for users. IAAS accounts for the majority share of the public cloud market at roughly 62% in 2018 or RMB27bn. This service business model is a pay-as-you-go model that offers users/consumers the benefit to reduce CAPEX and to operate more efficiently and with more flexibility. IAAS service providers can either build as well as self-operated data centers or lease from third party vendors.

As of 2Q19, the public Infrastructure-as-a-Service (IaaS) market was dominated by top internet players such as Alibaba and Tencent, taking 42% and 12% market share, followed by China Telecom, and Huawei with 9% and 7% market share respectively. As of the 3Q19, AliCloud and Tencent cloud was still growing at 64% and 80% year over year (YoY), respectively, showing no sign of a slowdown. In the private cloud sector, traditional network providers such as Huawei, ZTE, H3C, Inspur, Sugon, China Telecom, China Unicom, and Wangsu continue to dominate the market.

Growth Drivers of IAAS Market

The shift from private cloud to the public cloud, digitization of enterprises, and government entities are key drivers supporting cloud computing market growth in China.

Since a decade ago, Chinese Internet companies have been expanding rapidly in the public cloud market by investing heavily in technology and building out infrastructure. Through economics of scale, service providers could cut prices, creating price elasticity attracting more user adoption and higher consumption per user.

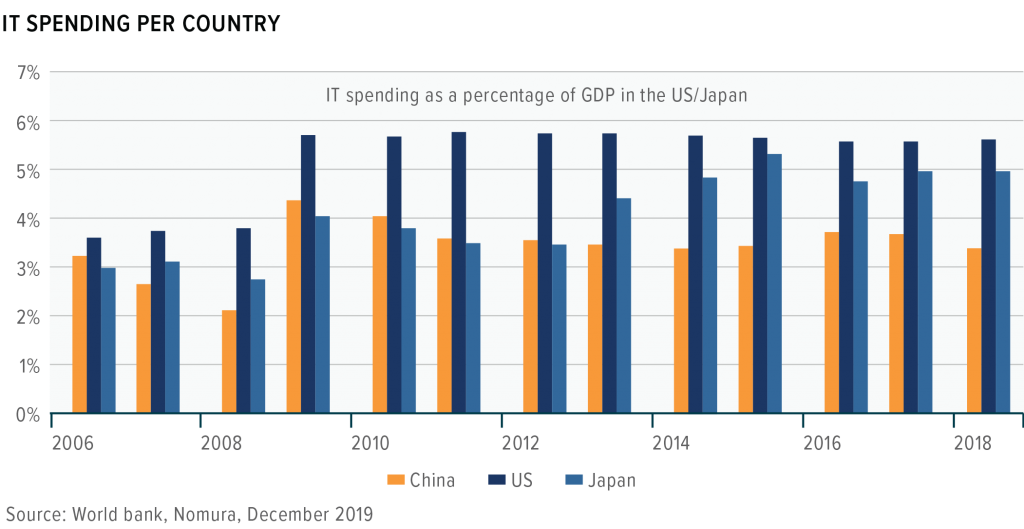

China’s IT service spending is a mere 3.9% of global IT spending in 2018, while the country’s GDP share in global GDP is as high as 15.7%. In fact, the pace of growth of IT service spending in China has experienced acceleration, particularly over the last three years owing to the faster development of the IaaS industry coupled with rising enterprise user awareness and general acceptance for cloud computing services. Finally, government policy support served as an invisible hand, pushing technology penetration to a higher level.

In the next few years, Infrastructure-as-a-Service market growth is expected to continue to deliver strong growth to normalize to a similar pace as data traffic growth eventually. According to a Cisco VNI report, data traffic is expected to grow +25% CAGR over 2016-2021 to over 20ZB (Zettabyte). Interestingly not captured in this estimate is the development of 5G, which is expected to drive more data traffic. Therefore, it remains challenging to quantify the ceiling of the market potential.

Disclaimer

This document has been prepared for presentation; illustration and discussion purpose only and is not legally binding. Whilst complied from sources Mirae Asset Global Investments believes to be accurate, no representation, warranty, assurance or implication to the accuracy, completeness or adequacy from defect of any kind is made. Unless indicated to the contrary, all figures are unaudited. The division, group, subsidiary or affiliate of Mirae Asset Global Investments which produced this document shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. The views and information discussed or referred in this report are as of the date of publication, are subject to change and may not reflect the current views of the writer(s). the views expressed represent an assessment of market conditions at a specific point in time, are to be treated as opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. In addition, the opinions expressed are those of the writer(s) and may differ from those of other Mirae Asset Global Investments’ investment professionals.

The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract which may exist between the parties. The issuer of this article is Mirae Asset Global Investments (HK) Limited (“we”) which we may or our managed funds may hold the mentioned securities. It should not be distributed to any other party except with the written consent of Mirae Asset Global Investments. Nothing herein contained shall be construed as granting the recipient whether directly or indirectly or by implication, any license or right, under any copy right or intellectual property rights to use the information herein. This document may include reference data from third-party sources and Mirae Asset Global Investments has not conducted any audit, validation, or verification of such data. Mirae Asset Global Investments accepts no liability for any loss or damage of any kind resulting out of the unauthorized use of this document. Investment involves risk. Past performance figures are not indicative of future performance. Forward-looking statements are not guarantees of performance. The information presented is not intended to provide specific investment advice. Please carefully read through the offering documents and seek independent professional advice before you make any investment decision. Products, services, and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries, and/or distributors of Mirae Asset Global Investments as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Before making any investment decision to invest in the Fund, investors should read the Fund’s Prospectus and the Information for Hong Kong Investors of the Fund for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are also advised to seek independent professional advice before making any investment. This document is issued by Mirae Asset Global Investments and has not been reviewed by the Hong Kong Securities and Futures Commission.

Staying Ahead with Mirae Asset’s Latest Insights

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.