THIS MATERIAL IS A MARKETING COMMUNICATION.

Asian Market Perspectives: Looking Forward, Positive but Selective

Markets globally are trading the end of lockdown and resumption in economic activities at inflection points going into or coming out of recession.

Unlike the Global Financial Crisis in 2008, Central Banks and Governments have quickly responded with measures to mitigate the lockdown impact and stabilize the financial system.

The USA and Europe lead the world in stimulus on the monetary and fiscal front. Their reserve currencies bring these countries much fiscal firepower. While the US stimulus is led by Republicans that control the government and 2020 presidential elections, the European stimulus of €1-1.5tn is a result of Franco-German efforts in keeping the European Union intact.

Even though major emerging markets such as China and India have announced significant stimulus packages, an in-depth analysis reveals that these packages bring limited fiscal support. A large part of the stimulus is monetary support that has been extended to the economy. We expected that large-scale infrastructure programs such as urban infrastructure in China, roads, and rural infrastructure in India will be implemented in the coming months to absorb the excess labor displaced from the service sector and urban areas.

Timing the Market

Stemming from concerns about the COVID-19, we saw post sharp outflows from emerging markets in the last three months. In our view, risk-reward remains very favorable. With backdrops of expanding central bank sheets and strong fiscal support, institutional investor positioning remains very bearish.

Outflows from EMs at 2.5% of market cap in March and April are higher than those seen during the GFC panic. As lockdowns end and economies open, monetary and fiscal support will feed through and revive activities. Without a large scale of second wave infections, the world will get used to living with the virus.

Analysts are much focused on the earning cut. The catalysts for this are a one-off lockdown event and the tendency for markets to the historical bottom.

Capture the Asian Opportunities

Performances vary across regions. North Asia, where was first to come out of lockdown, has strongly outperformed while India & ASEAN have lagged as lockdown ended merely a week prior.

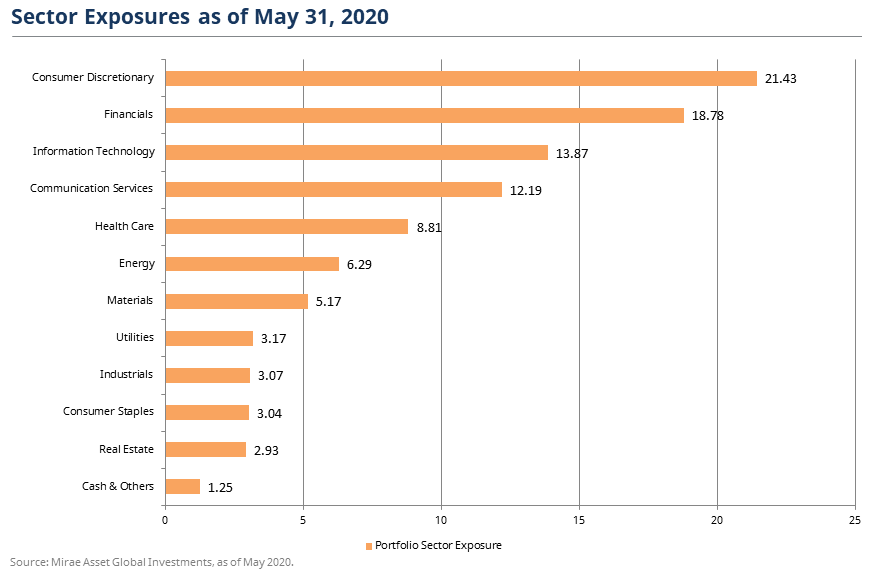

Within most markets, investors are primarily positioned in large-cap, such as tech-dominated stocks, while mid-small caps and cyclical sectors like financials & consumer discretionary are under-owned and should catch up as activities, e.g., ISMs, PMIs pick up.

Our Positioning

We believe that the worst global growth is behind us, aided by easy liquidity and low-interest rates, economies should slowly go back to near normal. In line with our GARP based investment approach, we continue to favor businesses with strong moats, cost, and technology leadership while being sold at reasonable prices.

Korea

We have increased Korean exposure for the past three months, preferring semiconductor names which could benefit from data centre demand and the smartphone upgrade cycle. EV battery producers continue to be in our core holdings as EV adoption goes mainstream globally on the back of strong policy support from governments to mitigate climate change.

In recent months, we have added high-quality financials, as valuations at 0.3x price/ book are factoring in extreme pessimism, despite robust balance sheets and their leading industry status.

We believe that Korea could benefit from a global economic upturn by being a neutral supplier of its advanced technology equipment and smartphones.

China

Our significant exposure is in technology platforms/super apps, which continues to gain a higher share of wallet through big data analytics and hyper-personalization of their offerings.

In addition to the Chinese healthcare sector, which remains a core part of our portfolio, we are positive for secular themes such as sportswear and after-school education.

In recent months, we have added selected insurance names as we believe their valuations are highly attractive after 12-15 months of under-performance and anticipate that growth should pick up in the coming quarters.

Despite nearly 45% of the Chinese exposure, we continue to hold an underweight position relative to MSCI Asia Index, which has almost 53% in China and Hong Kong. We believe risk-reward is better in India and ASEAN, where have under-performed in the last 12-18 months and are under-owned. High debt/GDP will constrain China’s ability to give large scale stimulus, while valuations are not factoring in the possibility of growth slowdown and heightened tensions with the US.

India

We are overweight in India; a stance that has proven to be a significant detractor over the last two and a half years. We believe a large number of dislocations in an account of goods and services tax implementation, and currently, COVID is behind us. As India opens up again, the number of COVID cases continues to be high. Having said so, we draw comfort in the low death rate of 4%, with total deaths of 7,500 (as of April 8). We believe that low-interest rates, coupled with increased FDI interest, could encourage economic recovery as was visible in January/ February prior to the outbreak of COVID.

We continue to like top quality financials with strong franchises as consumption proxies are expected to have demand recovery over the next couple of quarters.

ASEAN

The ASEAN region, such as India, has lagged North Asia’s recovery since late March, as most countries were still in lockdown. Even though we have seen a sharp catch up with the region opening up in the past few weeks, stocks are still trading at 20%-30% below pre-COVID levels. We continue to like consumer proxies such as Universal Robina and Security Bank in the Philippines, a pan Asian hospital chain listed in Malaysia, as well as jewelry retailer, and a consumer-focused bank in Vietnam.

As risk appetite normalizes in the coming months, these names, which are industry-leading franchises in their respective industry, could see a premium from superior growth rates and vast market potential. Consequently, our ASEAN exposure, so far a detractor, should subsequently be a positive contributor to portfolio's performance.

Downside Protection in a Cyclically Positioned Portfolio

In the near-term, markets may continue to be volatile with heightened US-China tensions on trade, geopolitics, and technology. The debate on the adequacy of stimulus to overcome deflation will influence sector performance. However, what typically happens after a pandemic - or a war? Policymakers usually take it as an opportunity to kick start economic growth through state programs and ease pressure on the most vulnerable sections in society.

We believe our multi-pronged approach (highlighted below) with discipline on valuations should help the fund do well as risk appetite normalizes, and stock picking becomes a key differentiation.

Be among the Dominant Leaders - Strong, transparent management with thought leadership

Healthy Balance Sheets - playing operating leverage not financial leverage

Emerging Sector Leaders - Mid/small caps which are leaders in promising categories

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature/ . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: This document is intended for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.